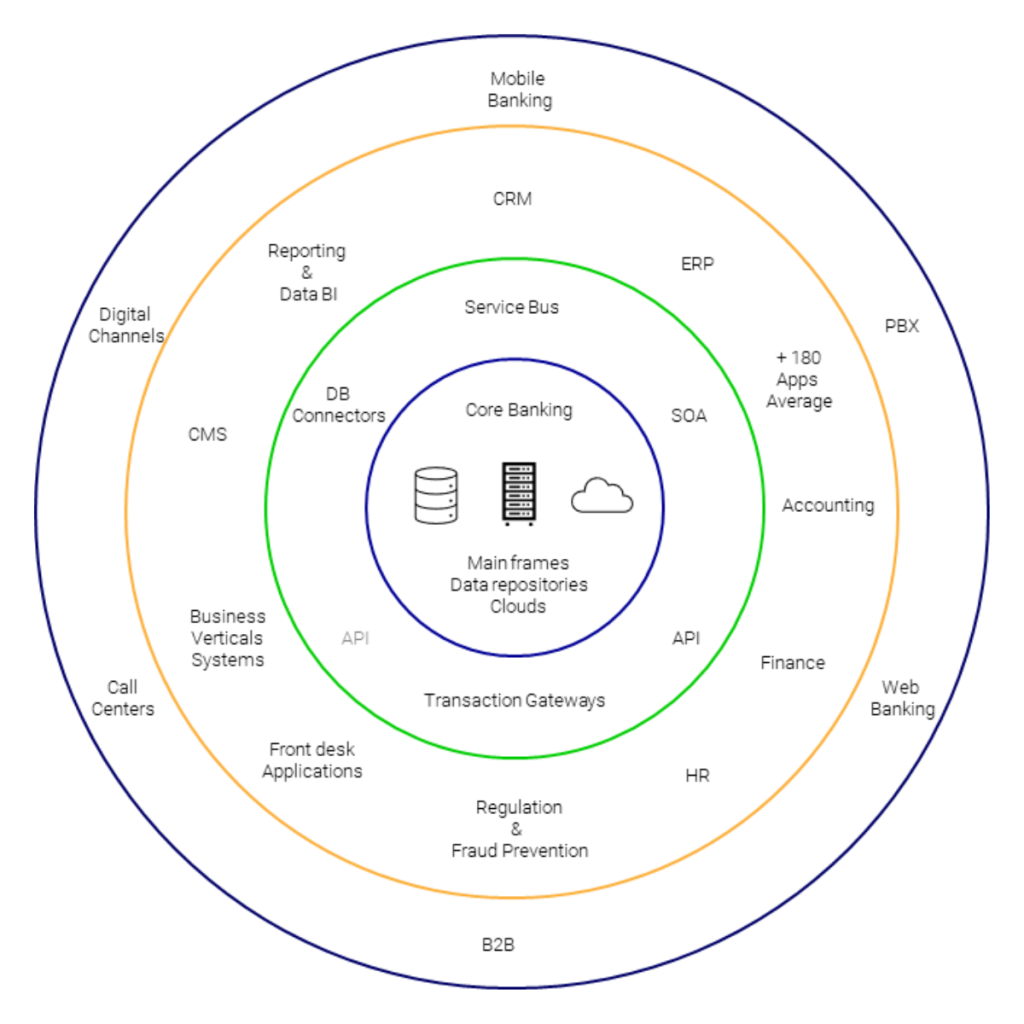

Our banking services portfolio

1. Software development and maintenance projects

- Web banking Apps

- Mobile banking apps

- Core banking

- Back office and Satellites solutions

2. IT consultants staffing

- Software Developers

- Systems, platforms, and database administrators

- Software and Cloud Architects

- Projects managers & Scrum Masters

- DevOps / CI-CD

- Quality experts – Software testing

- UX / UI

3. Cloud & On-premises infrastructure management

- Disaster recovery / High availability

- Architecture

- Monitoring, maintenance, and support

- Backups and legacy

4. CyberSecurity

- IT & Cloud

- Finance & Banking

- Software & Embedded

- Operations Technology

- Governance, Risk & Compliance

- Managed Services

- Enablement

Our customers select us because...

Commitment

Flexibility

globality

competence

cost effectiveness

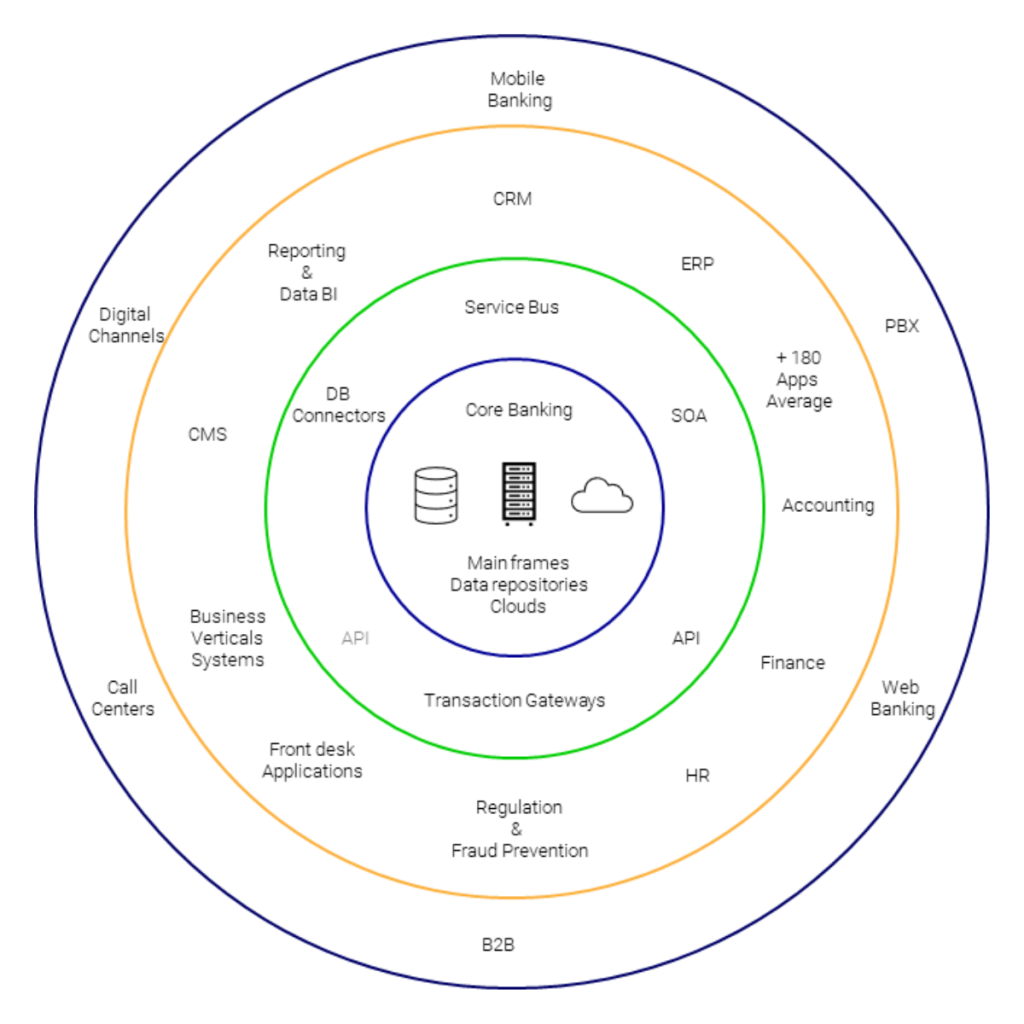

Cybersecurity Banking

IN THE BUSINESS AND UNDERLAYING TECHNOLOGY

Enterprise Architecture

Production Support

PMO - PROJECTS

OSI MODEL

7 Application

6 Presentation

5 Session

4 Transport

3 Network

2 Data link

1 Physical

BUSINESS

Software

Hardware

Network

Infrastructure

Process

Governance

Regulation and compliance

Business requirements and services

Information

Training & Auditing

CYBERSECURITY

High level vision of the topics to cover when we speaks about cyber security in banking and finance sector environment.

Enterprise Architecture

Production Support

PMO - PROJECTS

OSI MODEL

7 Application

6 Presentation

5 Session

4 Transport

3 Network

2 Data link

1 Physical

BUSINESS

Software

Hardware

Network

Infrastructure

Process

Governance

Regulation and compliance

Business requirements and services

Information

Training & Auditing

CYBERSECURITY

High level vision of the topics to cover when we speaks about cyber security in banking and finance sector environment.

With you every step of the way

Experienced in today’s business solutions

Consulting

Digital transformation

IT enterprise architecture

IT processes and best practices

Implementation & Execution

Fixed Priced Projects

Staffing & Monitoring

Web APP software development and mobile APPs

Software quality assurance

“On-Premise” cloud IT infrastructure management

Architecture, support and BPO monitoring in the cloud

Support

Cloud architecture, support, resale, monitoring

“On-Premise” architecture, support, (BPO)

Our customers

Partners

Certifications

Contact us

Our solutions contribute to the fulfillment of the organizational objectives of each of our clients because they align to your needs.